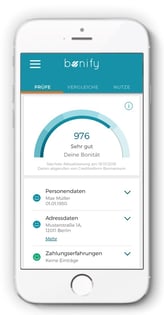

In Germany, creditworthiness for end-customer transactions are worth 350 billion EUR per year. However, credit information is often incorrect, incomplete and in generally unhelpful. This leads to poor conditions for the consumer due to contract rejections. Bonify wants to fix this by offering consumers free credit checks and better transparency using a unique algorithm that helps match users with financial institutions that actually benefit them. This technique helped Bonify win the Silver Stevie® Award in the Technology Startup of the Year category in the 2017 German Stevie Awards.

Dusting off Bad Credit

Ultimately, Bonify wants to educate their customers about the ills of bad credit. Elisa Thiem, content contributor at Bonify, speaks to the growing issues of bad credit and the lack of tools available in Germany.

“Surprisingly, few people know what credit means at all, when it’s relevant and what impact it has on everyday decisions. With our lively international team of 33 people, the financial world will be revolutionized. We not only offer free credit checks and clarify your credit ratings, but also exciting financial management tools to optimize your finances.”

“Surprisingly, few people know what credit means at all, when it’s relevant and what impact it has on everyday decisions. With our lively international team of 33 people, the financial world will be revolutionized. We not only offer free credit checks and clarify your credit ratings, but also exciting financial management tools to optimize your finances.”

An Algorithm Saved My Life

The way Bonify assesses someone’s options is by calculating their electricity, gas and DSL usage, then the “savings calculator” allows users to find the lowest and most convenient fares to use instead. Elisa says this makes adjustments a lot easier, “especially in the field of loans, it’s exciting to finally get registered users matched with tailored credit options and individualized offers.”

Bonify’s long-term goal is to integrate all consumer products where credit plays a role (insurance, mobile phone contracts, etc.) so everyone can easily understand the best options available to them.

Rewards for You, Rewards for Us

Bonify is grateful for opportunities that help them in their fight for transparency, and award recognition is no exception. The team is well aware of other companies who've been growing in their respective markets and who believe they belong in that league as well. Elisa relays the positive attention cast on their team and how they feel.

“We were looking forward to the technology startup of the year for the German Stevie Silver Award and are still very proud! We feel great joy and pride for all employees, customers, investors and friends. Excellent customer response and confidence are a great confirmation from the positive feedback so far.”

Not Changing is the Biggest Risk

The increasing digitalization of industry and business models provide opportunities in the field of risk and credit ratings for companies and customers. Bonify is always looking for new ways to streamline credit check processes. Elisa shares their enthusiasm in the wake of their success.

“We want to and have helped many people learn more about the topic of credit and how to improve it. From numerous personal conversations in customer service, we get a lot of interesting cases and are always glad to help. A personal credit history of our former employee, Philipp Hommelsheim, was rejected as a BKA official with a good salary and positive payment history due to its poor credit rating from DriveNow.”

Protecting Your Data

The positive customer responses, the constant support of friends and investors and the motivation and enthusiasm of their employees are encouraging. However, customer information is their top priority and a major reason why the company has been growing at such a rapid rate. Elisa wants to highlight their focus on this important matter.

“Bonify is working hard to continue improving even further so that topics such as creditworthiness and financial optimization or borrowing are communicated openly and transparently. We focus on data protection. We are aware that your data is sensitive, which is never passed on to third parties without being asked.”

Since the user is already prequalified based on the individual credit and financial situation for loans, manual processes for banks are shortened and more accurate. Bonify acknowledges that not everyone is aware of their credit decisions. With a free credit check and their financial optimization tools, individuals can look forward to their credit scores improving with the right information and tools.